Table of Contents

If you’re running a WooCommerce store, there’s no way you can do without a WooCommerce tax plugin. Trying to manually add in the code to calculate the taxes for different types of orders and from different countries simply won’t be practical.

Using the right WooCommerce tax calculation plugin holds a lot of importance. So before we actually get to reviewing the best tax plugin options, let us take a quick look at why you absolutely need to use it on your store.

The Importance of a Tax Plugin for a WooCommerce Store

Let’s face it. Managing taxes is always a complicated process, but sales taxes are even more challenging because they involve so many different regulations and slab rates. And the struggle can get to a whole new level if you’re selling in multiple countries, because in that case you would be required to keep up with multiple different tax systems.

In fact, even many states and cities have different sales tax laws.

A good WooCommerce tax plugin will help automate the entire process. It will automatically calculate the sales tax on every order depending on the location of the customer.

Moreover, trying to set things up yourself with respect to adhering to each of the tax systems can be complicated and even risky. There’s always a possibility of human errors.

And a human error here can be costly. You just don’t want to be on the wrong side of tax regulations in any way.

Using a tax plugin will also help you save a huge amount of time compared to setting up manual processes. Then there’s the reporting, monitoring, and accounting.

All these things will be a lot easier and time-saving with a plugin than trying to do everything manually.

Finally, a good tax plugin will also make things look a lot more organized, accurate, and trustworthy to the end customer on the front end. So all in all, there’s no reason to overlook the importance of a WooCommerce tax plugin.

With that said, let us get to reviewing the 5 best WooCommerce tax plugins out there, including both free and paid options.

Best WooCommerce Tax Plugins

We have comprehensively reviewed these plugins on different factors and found them to be the best options depending on your needs, while covering everything you need to know about them in our reviews.

WooCommerce Shipping & Tax

WooCommerce Shipping & Tax is the official tax plugin from WooCommerce. It’s also the most popular tax plugin for obvious reasons.

It’s simple to set up and just as easy to use. In fact, you don’t have much to do once you set it up for the first time.

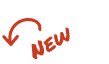

But before you set it up, you need to make sure the Enable tax rates and calculations option is checked in the general settings. You also need to click on the Save Changes button at the end of the page once you do this.

Now the page will load again and you will see the Tax tab where you can manage the settings for this plugin.

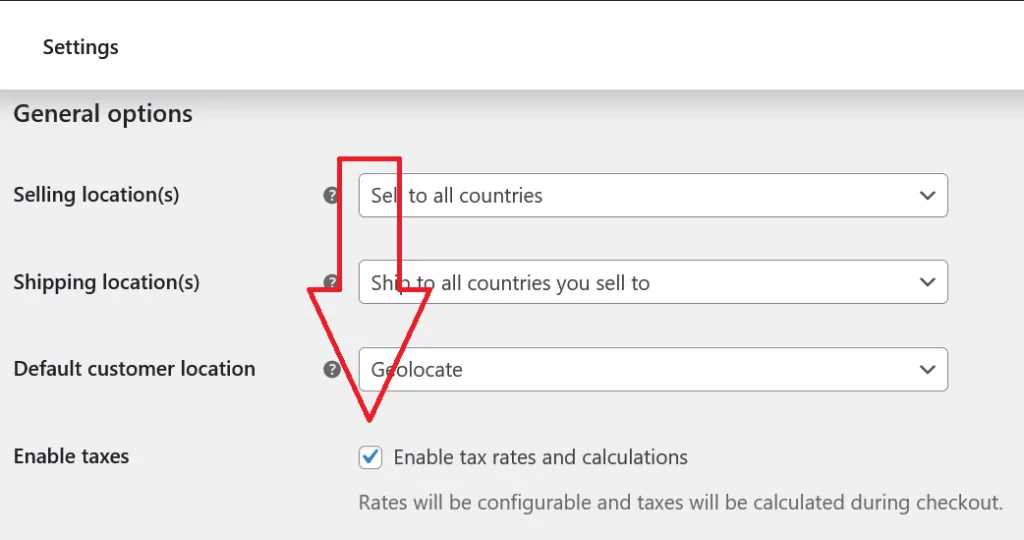

If you enable the automated tax calculation feature, you can just go back to doing your thing and forget about the tax hassles. This plugin will automatically calculate and add the tax amount to the customer’s order value once they enter their shipping address.

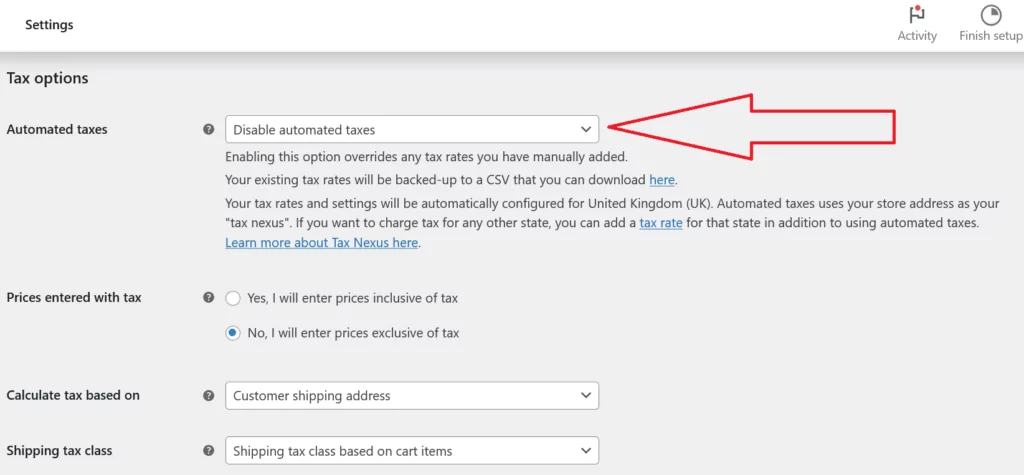

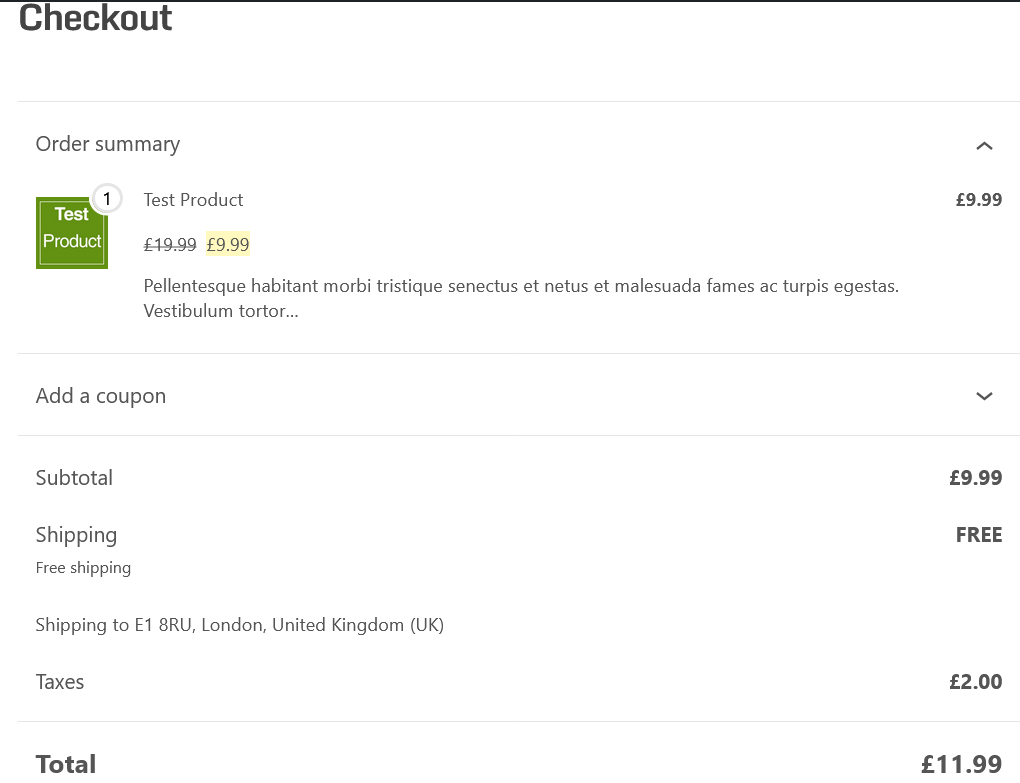

In our example below, we added our test product to the cart.

Then we went to the checkout page. So far, the WooCommerce tax does not show in the cart.

But as soon as the shipping address is entered, the final total is changed in real time with the tax amount added based on the shipping.

In other words, this plugin will calculate the tax amount based on the location of the customer, which is why the amount is added after the shipping address is entered. You have the option to change it to the billing address too, though.

In addition, it also takes the product class into consideration, which is another factor when calculating the sales tax on a particular product.

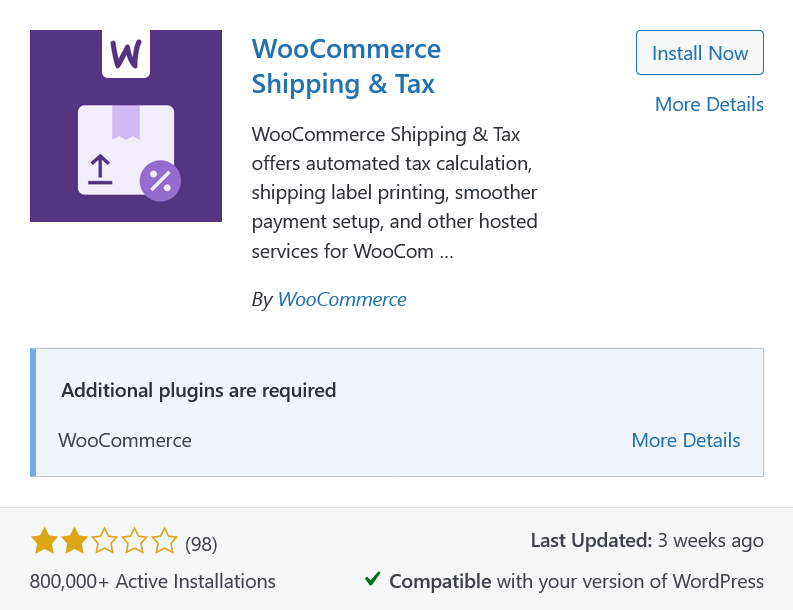

Surprisingly, this is a free WooCommerce tax plugin. However, you must also note that this plugin no longer offers any shipping features, although they haven’t changed the name to reflect this.

We would also like you to take note of the fact that this plugin hasn’t received very impressive reviews. With over 800,000 installations, it only has a rating of 2.

However, the most common issue that led to most of the negative reviews has been resolved in the recent updates.

This plugin required Jetpack to work, which many users weren’t happy about. But it now works on its own with no dependency on the Jetpack plugin.

Paid Member Subscriptions

Paid Member Subscriptions is the most versatile WooCommerce plugin for handling tax payments and calculations for membership sites. But that’s just one of the features it offers.

Paid Member Subscriptions is a complete WordPress membership plugin. It not only manages the entire tax management process on your store but also offers many useful core functionalities like the ones listed below.

- Create important pages like a basic WooCommerce Lost Password Page;

- Restrict content in WordPress to sell group memberships as well as individual memberships;

- Accept recurring payments through different payment methods;

- Create and operate a fully functional subscription website from scratch;

- Access to advanced features through Pro Add-Ons like content dripping, invoices, and more.

There are many other smaller functionalities too. But to remain on the same page with the context of the topic, let us dig deeper into how efficient Paid Member Subscriptions turns out to be as a WooCommerce tax management plugin.

Before we proceed, you must note that Paid Member Subscriptions is designed to be a subscription site plugin. So it would be a perfect solution for your WooCommerce store only if you’re selling memberships, subscriptions, or other products with recurring billing.

If you operate a standard WooCommerce store selling physical one-off products, you might find the WooCommerce shipping tax not working with this plugin. But that’s only because this plugin is designed to be a membership or subscription plugin and does not work in the same way for general product stores.

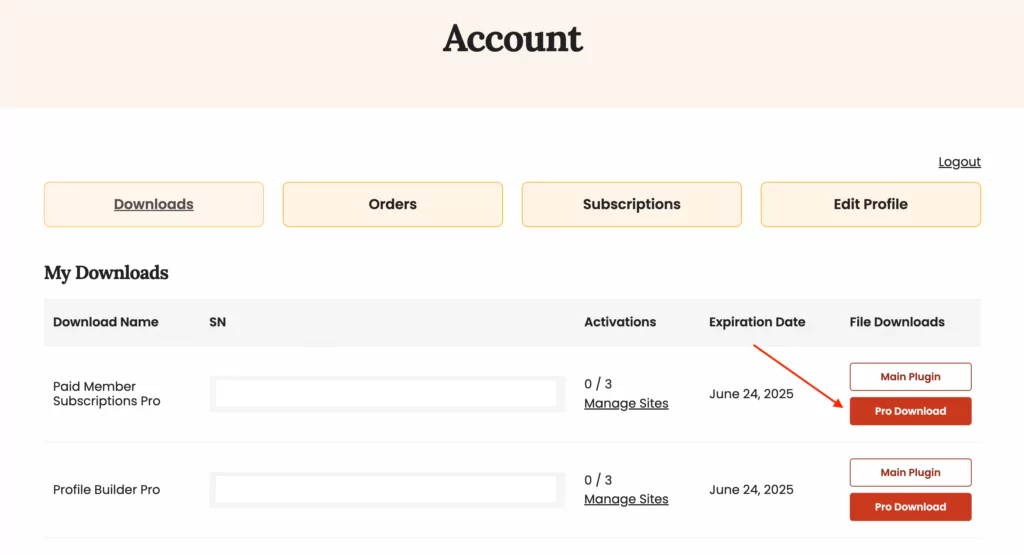

Coming to the setup process, you first need the pro version of Paid Member Subscriptions to use the tax management functionality. You can purchase it from here.

Once purchased, you can download both the free and pro versions of the plugin from your account on Cozmoslabs.

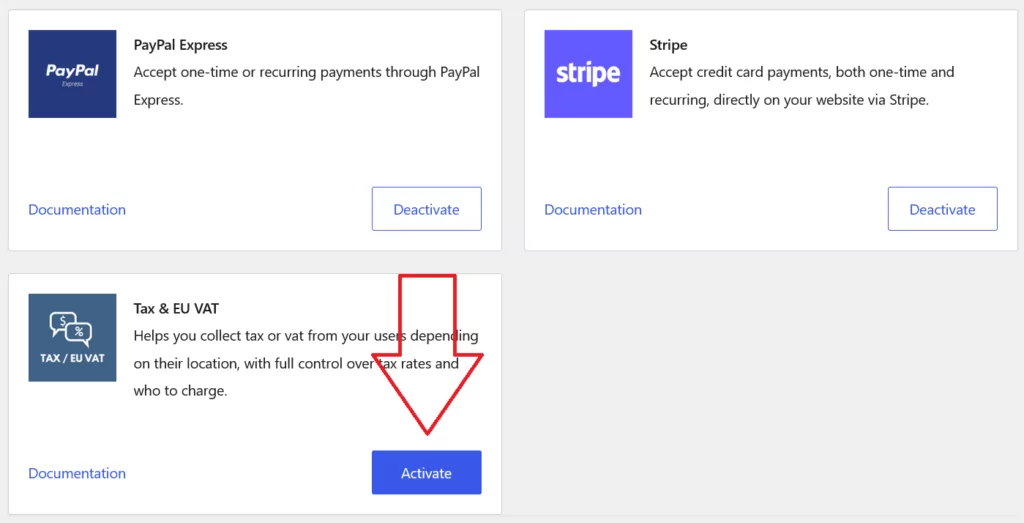

Then upload both plugins to your store using your WordPress dashboard. After installing and activating both the free and pro versions of Paid Member Subscription, you need to activate the Tax & EU VAT pro add-on.

To do this, click on the Add-ons option under the Paid Member Subscriptions menu. Scroll down to the Pro Add-Ons section and click on the Activate button for Tax & EU VAT.

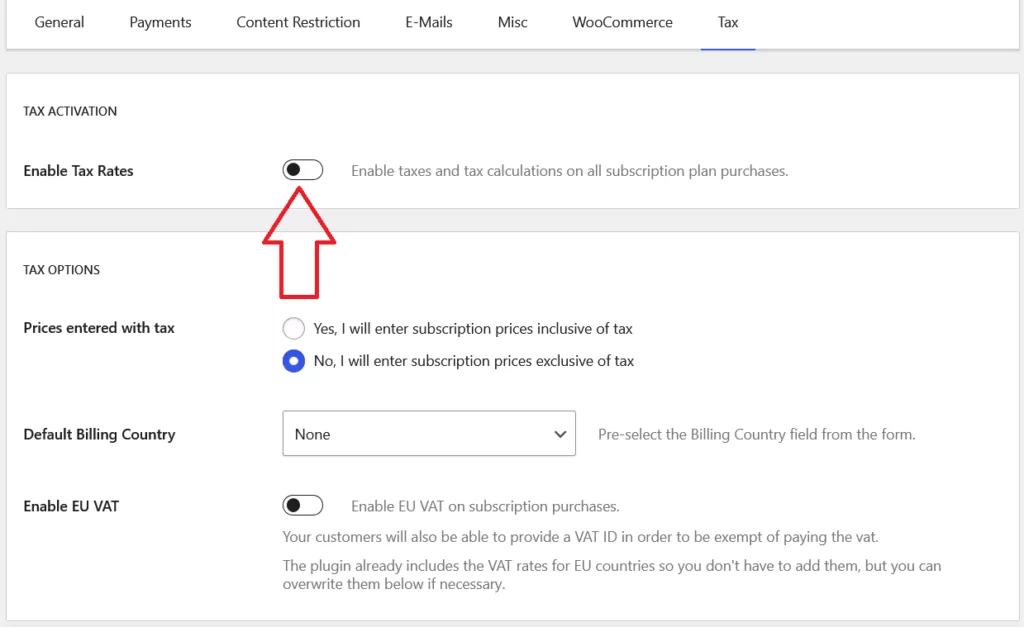

Once activated, a new tab named Tax will appear on the Settings page under Paid Member Subscriptions. You will be able to enable the tax functionality as well as manage all the other tax-related settings on the page.

When you enable the Enable Tax Rates option above, the customers will see prices updated with the taxes on their purchases on the checkout page. Make sure you click on the Save Changes button at the end after choosing all the right settings for your store.

In the same screenshot shared above, you can also see the option for Enable EU VAT. When enabled, it will allow your customers to submit their VAT Number to claim their tax exemption.

An important thing to note here is that if some of your customers find that the automated taxes are not working on your WooCommerce store, then that may be because they are from a non-EU country.

There’s a separate set of settings to manage the tax rate for non-EU countries. On the same Tax settings page, you need to scroll further down and you will find the option to enter the tax rate manually for other countries.

You need to do this by uploading a CSV file containing the details for the states and countries you wish to upload the custom tax rates for. Please refer to this document to understand more about this feature.

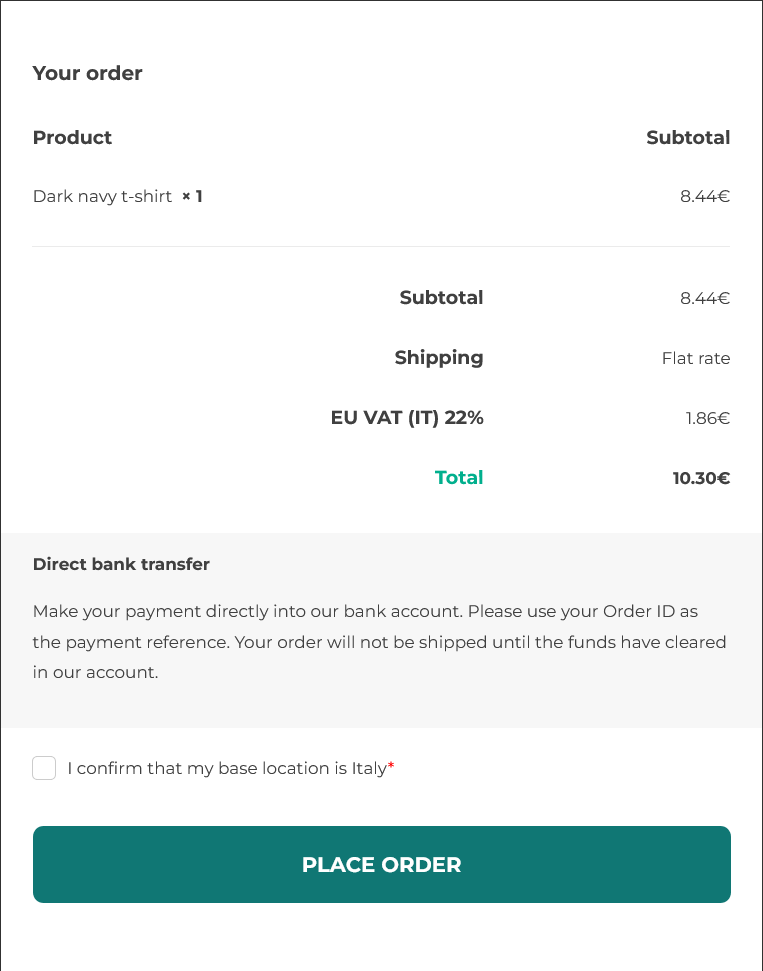

Now here’s how the subscription product price calculation with the taxes added will look like for the customers on the front end.

You will need the Pro version of Paid Member Subscriptions to be able to use its tax functionality, which is priced at €169 per year. It comes with a long list of useful advanced features in addition to the tax functionality and will totally be a worthwhile investment for subscription site owners.

Paid Member Subscriptions Pro

Paid Member Subscriptions is one of the few plugins that collects taxes on subscription payments successfully while offering many other features.

Get Paid Member SubscriptionsYITH WooCommerce EU VAT, OSS & IOSS

First things first, the YITH WooCommerce tax plugin is specifically designed for customers in Europe. In other words, you can use this plugin only if you want to handle sales taxes for customers from European countries. For customers from other countries, the tax will not show in the cart.

This plugin gets all the basic things done, such as importing the VAT rates for all the European countries and adding the applicable tax amount to a customer’s cart amount.

However, it also offers some unique functionalities. Let us list them below.

- Automatically detects the customer’s location through its geolocation functionality;

- Asks for confirmation if a particular user’s billing address is different from their IP address;

- Allows you to show the VAT number field on the checkout page for tax exemption and also the option to make it mandatory or optional;

- Prevent customers without a valid VAT number from making a purchase, which might be useful for B2B exclusive WooCommerce stores;

- Handles the OSS (One Stop Shop) regulations required by the European Union without manual intervention;

- Allows blocking all customers from European countries from making purchases.

The setup is pretty simple, and this plugin works perfectly for EU customers. Here’s a quick look at the plugin automatically calculating the required VAT tax for a customer from Italy.

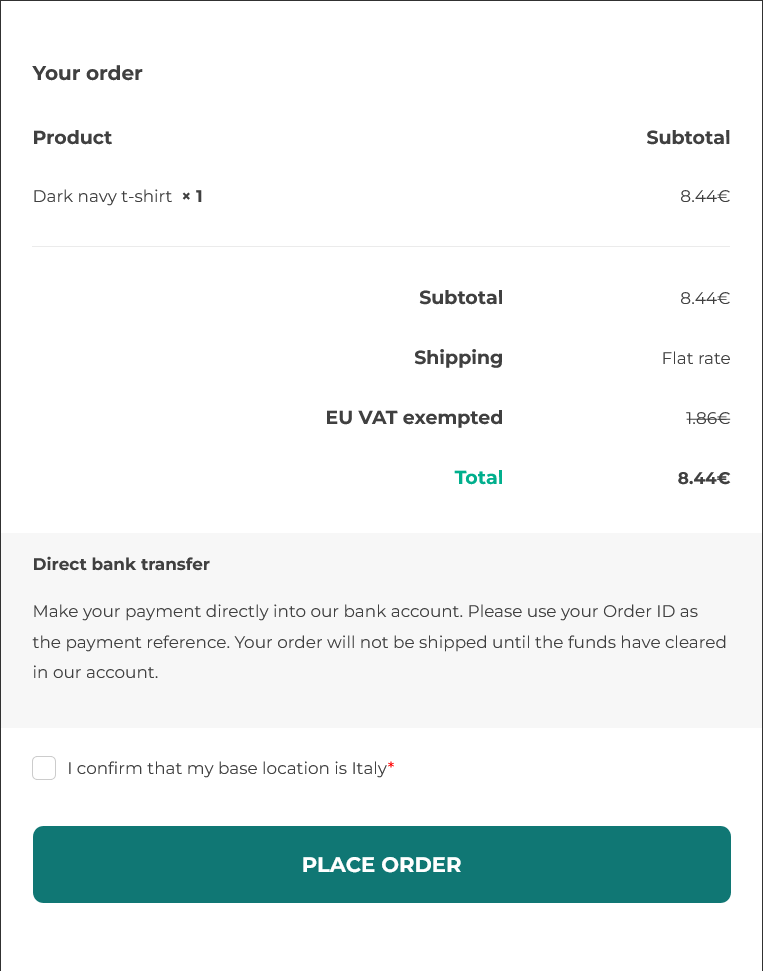

But we used a VAT number to claim tax exemption and the plugin immediately waived off the VAT amount.

The plugin is priced $79.99 per year and comes with a year of support and updates as well as a money-back guarantee for a period of 30 days from the purchase if you don’t like it.

Avalara AvaTax for WooCommerce

This is another free plugin available for WooCommerce stores. But you need to download it directly from WooCommerce’s official website.

In addition to calculating the sales tax for orders depending on the customers’ location, it also prepares tax returns for you. Unlike some other plugins focused on specific regions like the EU, this plugin covers a wider base globally.

It claims to offer a highly accurate system for detecting customer location. Then there’s also the functionality of automatically identifying cases where an exemption can be given, support for B2B transactions, and built-in tax rules for most states and different countries.

On the flip side, some users complain of poor customer support. Some even mention that the plugin encounters many issues when handling subscription payments.

That being said, probably not your best choice if you’re selling subscription products in particular. But for smaller WooCommerce stores selling products that require accepting payments with the sales tax for one-time purchases, this plugin may turn out to be a good option as a free plugin.

TaxJar

TaxJar is one of the more popular free WooCommerce tax plugins out there. It’s designed to just be a tax plugin without offering any additional features.

However, the seemingly good thing about this plugin which makes it stand out is that in addition to calculating the sales tax automatically on purchases, it also reports the collected tax information to the relevant state authorities automatically. It claims to never let you miss a due date!

Another interesting functionality is its ability to offer regulatory insights based on the data collected from your transactions. It will suggest whether your sales turnover has exceeded certain limits with respect to a particular state’s regulations. This will help you stay on top of your regulatory obligations too.

Now, while these claims sound pretty impressive, not all store owners are impressed with the plugin. Many of them point out that it’s mostly only a free plugin on paper since it requires a minimum plan of $19/month just to make it work.

Some users even mention that it only covers a very basic level of functionality, and you will eventually need to move to the $99/month plan. Of course, this might not be affordable for every user.

Finally, some users have also reported an issue that caused the plugin to show the sales tax on the front end but fail to collect it during the payment, causing significant losses for the store owners. Another issue talked about by users was the tax not showing in the cart on their WooCommerce stores.

All in all, if you run a large WooCommerce store with someone monitoring the sales taxes and are willing to shell out $99 per month as your transactions hit certain limits, TaxJar might still be a good option for you.

The Right WooCommerce Tax Plugin Depends on Your Use Case

We have shared detailed reviews of the best, most popular WooCommerce tax plugins which include both free and paid options. However, the exact choice will come down to what kind of store you’re running and the type of tax collection system you want to build.

To be specific, if you’re running a standard WooCommerce store selling products that require receiving the payment with sales tax only once, the YITH WooCommerce tax plugin can be a solid option. But if you want to stick to a free plugin, you can try out WooCommerce’s official tax plugin reviewed above or maybe even the TaxJar plugin.

For very small stores, the Avalara AvaTax plugin may work out just fine, too.

However, if you’re looking to build a subscription or a WooCommerce membership site, Paid Member Subscription is going to hit the spot perfectly for you. It’s specifically designed to be a WooCommerce membership plugin and covers everything you would ever need while building or running a subscription website successfully.

Paid Member Subscriptions Pro

Paid Member Subscriptions is the most complete subscription site plugin that also collects taxes automatically on subscription payments.

Get Paid Member SubscriptionsIs there anything you want to ask that we did not cover in this post? Please let us know in the comments below.

Related Articles

How To Create a Divi Membership Site

If you’re thinking of building a membership site in WordPress, you’ll need a solid theme and a membership plugin that pairs well with it. In this complete guide, we’ll show you how to create a Divi membership site using the popular Divi theme in combination with the Paid Member Subscriptions plugin.

Continue Reading

How to Hide Products by User Roles in WooCommerce?

Do you want to easily hide products by user roles in WooCommerce? Some WooCommerce store owners have a unique requirement where they want to hide certain products from all but a few specific groups of users. There may be many reasons for this, including selling exclusive products only to the more loyal customers, with a […]

Continue Reading

How to Create WordPress Redirects to Another Page, External URLs, or a Subdomain

There are different reasons WordPress site owners want to create WordPress redirects to another page, external URL, or a subdomain. The redirect can be based on an important user action or set up to redirect all users landing on a particular page. Whatever the type or need of your redirect, WordPress offers the flexibility to […]

Continue Reading